About us

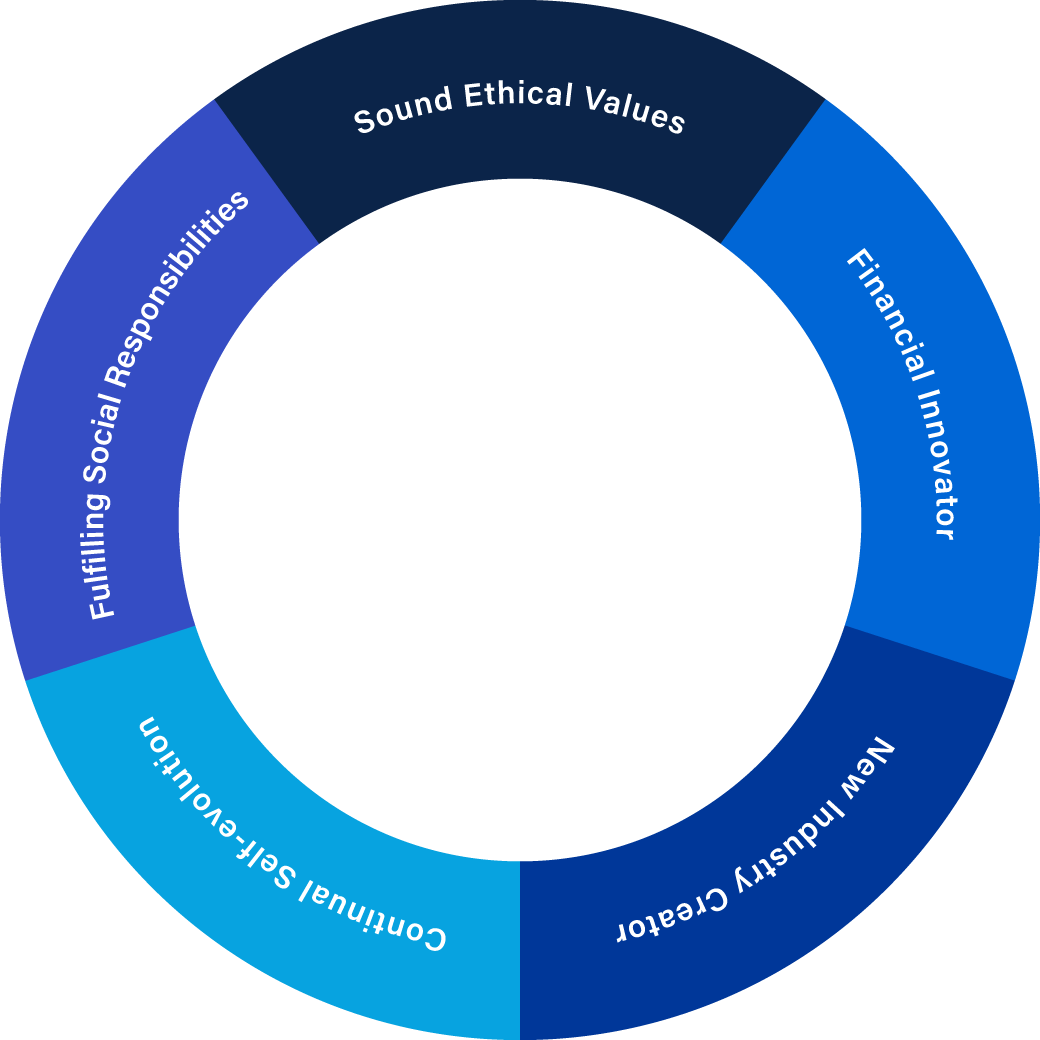

SBI Liquidity Market is a part of the SBI Group, Japan’s largest on-line financial conglomerate, that provides various FX and derivatives services for the Group and external clients. Keeping with the customer-centric principles of the SBI Group, we maintain the highest levels of professionalism and expertise to deliver price-competitive, user-friendly, and reliable FX services to our customers.